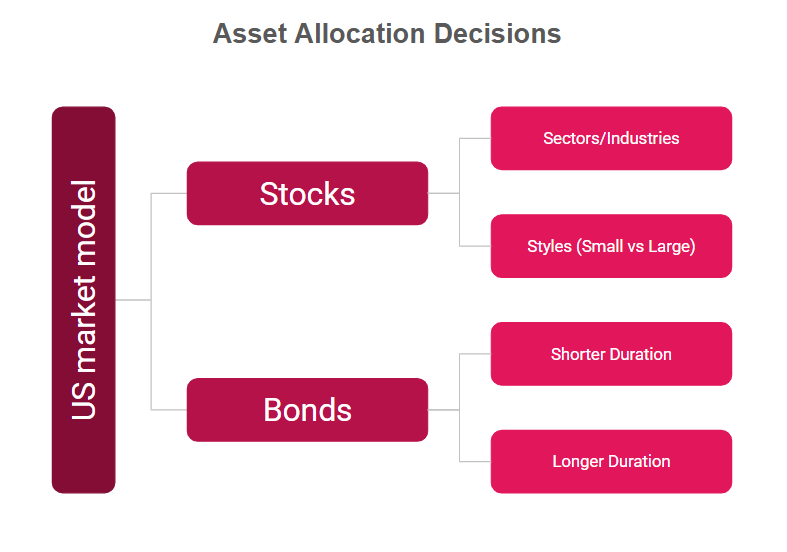

Our models help investors make these allocation decisions

Our current offerings are based upon our Regime-Based Asset Allocation Framework – a proprietary method for classifying risk regimes, leveraging 35 years of historical data. Our framework is a powerful tool for helping investors manage asset allocations. Based on this framework, we provide:

Regime-State Updates – For investors who wish to create their own strategies based on our framework, we can provide ongoing reports on current market regime classifications, along with expected returns and risk for each state.

Model Portfolio Service – Our model portfolio service is a subscription service whereby we create, manage, and maintain investment models and update subscribers as adjustments occur within the models. All of our models are rules-based and evidence-based, tested over decades.

If you have a different mandate from our model offerings and want to explore how our framework may help, please message us.